How much money do you REALLY need to make in your business?

Big question for you, and one that 99% of wellness entrepreneurs can’t answer: how much money do you really need to make in your business?

Why can’t most people answer this? Because very few know their important business numbers, and we’re going to talk about this today because it’s the basis for ALL your goal setting, business development, and marketing efforts you’ll do over the next year.

Listen to a few podcasts or do a little Googling, and you’ll notice that there are so many business coaches and entrepreneurs who talk about their $10,000, $20,000, or $50,000 months. Or the people who openly share that they make 6 figures ($100,000), multiple 6 figures, or 7 figures ($1 million dollars) per year in their business.

Hell, even I’ve shared that I had a $200,000 a year business in 2018, with all the details that you probably never wanted to know (and I’m going to do another year in review for 2019, too —> my generated income was a bit lower at $170,000).

Why do I talk about money so much? Because:

You can’t pay your bills with Instagram followers and Facebook likes.

There’s a huge difference between making $100,000 in your business and actually paying yourself $100,000 from your business (some 7 figure business owners only take home 10% of their sales); and

Most wellness entrepreneurs don’t make a full time income, despite being amazing health practitioners and knowing their stuff.

My mission in life is to get more wellness entrepreneurs making more money with less stress, but here’s the thing:

You don’t need to make a million dollars to be successful, you just need to make enough so that you can live the good life you defined for yourself.

Are you telling yourself you need to make “more”? What does “more” even mean? Do you want “more” money to buy a bigger house? For local organic groceries? For a family trip once a year? To build up your retirement account so you can retire at 55?

How much “more” do you actually need? And how much of your product/programs/services do you need to sell to make that?

Because if you don't know that number, you could drive yourself crazy trying to achieve other peoples' goals ... or find out, like I did, that making $200,000 in a year didn't make me any happier.

I’ve seen it happen time and time again that when you feel like you have to arbitrarily make “more money”, it can sometimes make you feel desperate (even if you’re not aware of it), which repels people. It’s almost like they can energetically sense it, and working with you just won’t feel 100% to them because they can feel your agenda.

There’s nothing wrong with making more money for the sake of it, but I’ve found it more helpful, for myself at least, to know what number I’m actually shooting for to achieve my short and long term goals in my business and life.

Some people are surprised to find that the number they need to make is actually not that scary, and it’s totally empowering that they CAN achieve their biggest dreams … and others find out pretty quickly that they need to adjust either their expectations or their lifestyle to fit what they are making from their business.

You might surprise yourself to find that you only have to work with an additional 10 clients this year to make your dream income, which might give you the final push of motivation to work that tiny bit harder and smarter to make it happen. Or you might find that you have to work with 100 new clients, and that’s totally not realistic to the stage of business that you’re at.

Don’t worry, if this sounds scary or overwhelming, we’re going to walk through it step-by-step below so you can figure out exactly what income goal you want to achieve in your business!

I know from my 10 years of working at a bank, and also from my 12 years in business, that it’s rare to know your numbers inside and out like I do. But I also know that it’s incredibly useful and can cut down on your stress (and fights with your spouse) by about 50%.

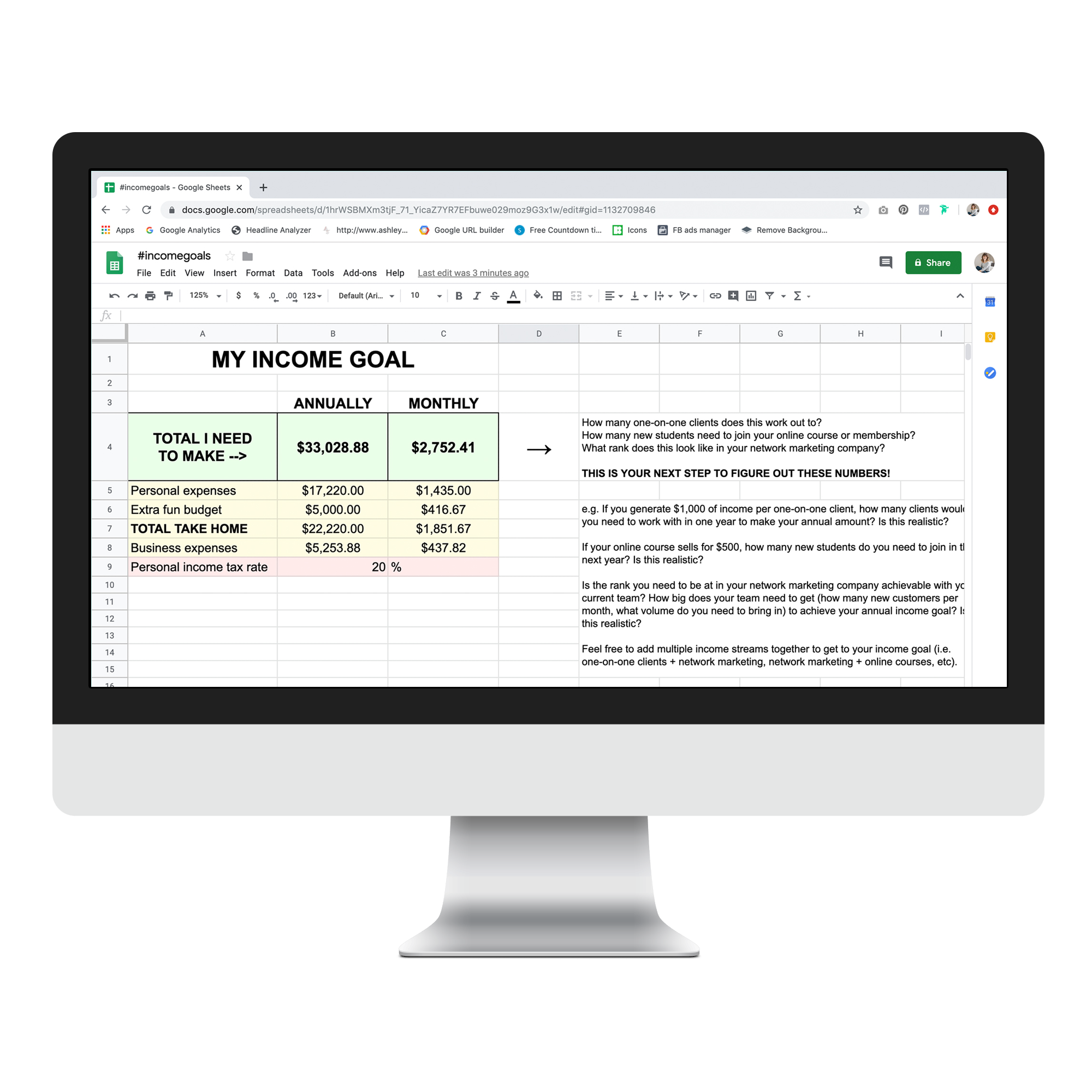

We’re going to go through an exercise now that, by working backwards, will show you exactly how much you need to bring in each month in your business to achieve your goals.

I urge you to then take the second step and figure out exactly how many one-on-one clients you need to work with, how many students in your online courses or membership, or what rank you need to be at in your network marketing company to make that happen.

Be specific! At the end, you should know whether you need to work with 10 clients or 100 clients one-on-one, be at a Silver rank or Diamond rank, or sell 5 spots or 500 spots of your online course.

You might need to take extra time to gather other information to complete this exercise, and you might even have to have difficult conversations with your partner, spouse, or other family members. Do it anyways.

I’ve never met a CEO who couldn’t have a difficult conversation. If this terrifies you, consider this your first training on your way to being the true boss you are.

Here’s how you can calculate how much money do you REALLY need to make in your business:

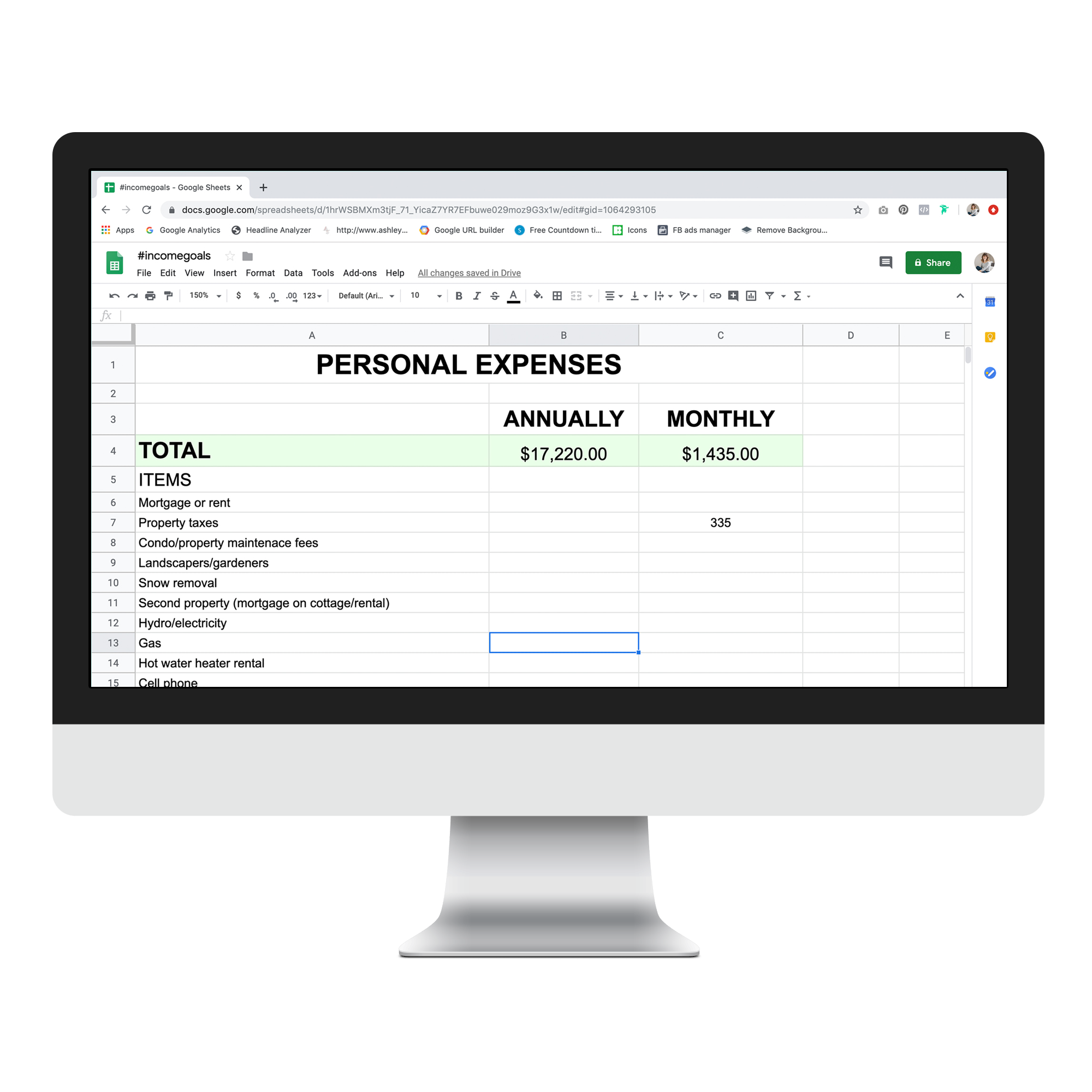

#1 Your personal expenses

Generally the first goal people want to achieve with their business is to leave their full time jobs or contribute to the family finances. So the first thing you need to know is what that number is.

Does your full time job bring in $4,000 a month right now (after taxes i.e. that’s how much is actually deposited into your bank account that you can spend), and you spend all of it on your regular personal and family expenses? That’s the number you’ll need to make in your business to replace that income.

If you don’t work right now, but your spouse keeps asking when you can contribute to the family finances, how much does that mean? What expenses do they want you to take over specifically?

For example, in our house, I pay for the groceries, property taxes, and after school care + summer camps for our son, and my husband pays the mortgage, hydro, gas, and house insurance.

When you’re calculating your personal + family expenses, I find it easiest to look at your monthly costs, and remember to include everything that you’ll need to cover, possibly including:

mortgage and property taxes or rent

property maintenance fees, including condo fees, landscapers, snow removal, etc

second property fees, such as a mortgage/loan and property taxes on a cottage or rental property

household utilities (like hydro, gas, electricity, hot water heater rental)

cell phone and/or regular land lines

internet

digital entertainment, such as cable, Netflix, Disney+ or other apps (my husband pays for a sports app so he can watch the NFL, it’s like $200 a year!), online games for your kids, etc

groceries

eating out

car and house insurance

car loans or leases

debt repayment

fuel or other transportations costs, like parking, highway tolls, or public transportation

loans/leases, fuel, and insurance for other vehicles, like a motorcycle, scooter, RV, boat, or historical car

health insurance

additional personal or family health expenses, like dentists, orthodontists, massage therapists, chiropractors, physiotherapy, etc

personal care expenses, like hair cuts, personal body care products, makeup, nails, eyelashes, etc

new clothes for yourself and family (what does this realistically cost you every year? Break it down per month)

school supplies

school fees (private school and/or school trips)

daycare or before/after school care for your kids

summer camps

vacations

sports, including costs of equipment, fees, tournament accommodations and food, etc

date nights and babysitting

gifts (Christmas, birthdays, etc)

giving to charity

miscellaneous other things like smoking and alcohol

If that looks like a lot to think about, that’s because it is! No one said living in today’s world was cheap, and depending on what city or part of the world you live in, these expenses will probably run you between $2,500 and $7,500 a month.

This article isn’t about personal expenses, but if you just got your eyes opened to how much you’re spending each month, look at what is a need to have (internet so you can run your business) versus a want to have (Disney+), and have a discussion with your family about what you can cut back on.

Again, this exercise isn’t necessarily going to be easy, but I promise you it’s worth it.

And remember, you might want to retire your spouse and cover ALL those household expenses, or you might only need to cover a certain portion of them. Only include the ones you want to cover for the purposes of this exercise.

You fill in the blanks, it will automatically calculate how much income you need to make!

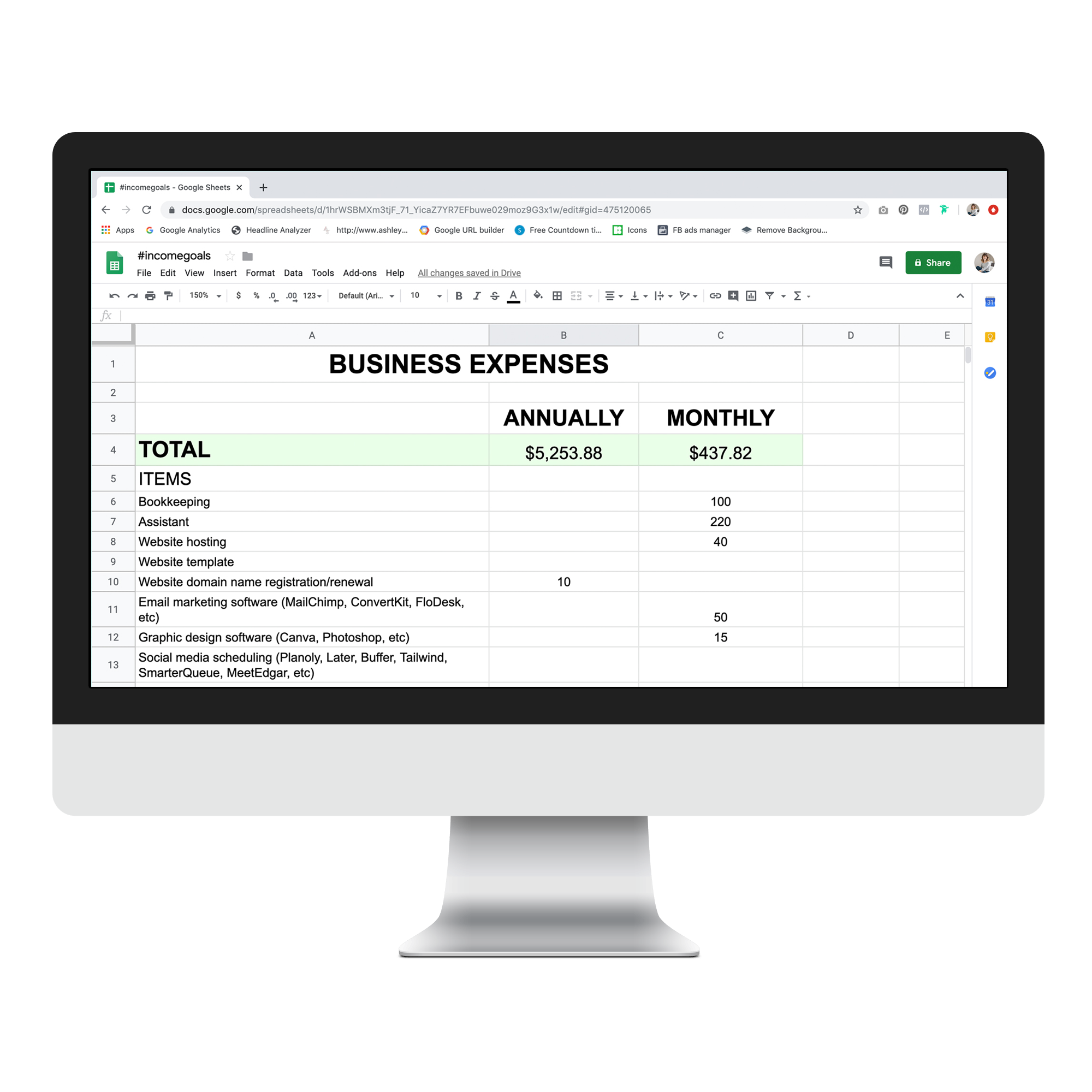

#2 Your Business Expenses

It’s not free to run a business, and the good news is that you only pay taxes on your gross income, which is the income you generate in your business minus what it costs you to run your business.

What you can legally “write off” in your business varies from country, state, province, and even city or municipality, so to determine what you’re eligible to count as business expenses, see a qualified accountant in your local area.

In my business, my regular monthly expenses total around $1,500 to $2,500 Canadian each month, and include things like:

Bookkeeper

Virtual Assistant

Pinterest manager

website expenses and yearly domain name renewal

software subscriptions for email marketing, graphic design, social media planning, online appointment booking, online course hosting, video conference calls, secure video hosting, countdown timers, password sharing, stock photos, and cloud file storage

checkout software and merchant fees

monthly doTERRA order (to collect my full commissions)

social media ads (mainly Pinterest right now, but I may branch into Facebook and Instagram ads in the future)

shipping

office supplies, such as paper, pens, post it notes, etc

my cell phone

Other business expenses I’ve legally written off include:

a portion of our household utilities (for example, I need the internet to run my business)

air and ground travel to events, plus accommodations and food while I’m there

new technology every few years, such as an updated computer/laptop, iPad (I use my iPad for some of my graphic design), phone, webcam, microphone, and printer

office furniture, storage, and decor

necessary home office upgrades (last year after we moved into a new house, I had to unexpectedly insulate all the walls and floor in my home office, as well as repair the roof above it)

gifts and events for my team

Now you don’t just go “writing off” everything and anything imaginable, that’s why you need to work with someone reputable in your local area to determine what’s a legal expense and what isn’t.

Remember that episode of Seinfeld where Kramer ships Jerry his own broken stereo (that Kramer himself damaged), and tells him to take it back to the post office and lie that it was damaged during shipping, because when Kramer shipped the broken stereo to Jerry he got $400 of insurance so they get some money out of it?

Jerry: “So we’re gonna make the post office pay for my new stereo now?”

Kramer: “It’s just a write-off for them.”

Jerry: “How is it a write-off?”

Kramer: “They just write it off.”

Jerry: “Write it off what?”

Kramer: “Jerry, all these big companies, they write-off everything.”

Jerry: “You don’t even know what a write-off is.”

Kramer: “Do you?”

Jerry: “No. I don’t.”

Kramer: “But they do, and they are the ones writing it off.”

This is what a lot of entrepreneurs do in their business, write everything off. I see so many people online saying to invest in certain things before the end of the year, because “it’s a write off” … but when you have expenses and write offs, that means YOU don’t get to take home as much money.

To me, I don’t care how much money my business makes, I care how much money I get to keep.

Also note: you will only be able to qualify for loans and mortgages from a bank (at least here in Canada) if you show you have a business income after expenses. If you write off most of your total income, so it shows close to zero and you pay way less taxes, you won’t be in a good position if you need a new car loan or mortgage. There is no way you can get around paying taxes, so don’t even try. The only person you’ll hurt is yourself.

Again, I have a free spreadsheet you can get below (keep scrolling) where you can fill in all your business expenses and it will add them up and factor that into how much income you need to generate.

If you’re just starting out and honestly don’t know how much your expenses need to be, you can probably get by in the beginning with about $500 in business expenses each month if you don’t rent an office space anywhere and work from home.

#3 Personal Income Taxes

I know so many entrepreneurs who hate paying income taxes, but here's the good news:

The more you pay in income taxes, the more money you made!

I remember the days when I made a negative income in my business (yes, it’s possible, meaning I was spending more on business expenses than income I was generating), and got a refund on my taxes. Yay, right? Not yay.

Other than that income tax refund, I had NO MONEY. Like, none. We were living entirely off my husband’s income, and I felt so guilty spending any of it. I wanted and needed to make my own money.

Was it annoying as hell to pay $34,000 in income taxes in 2018? Yes. But that means I made $200,000 before expenses, and $120,000 after expenses (what that tax was based on). Am I a million times happier paying income taxes? Hells yes!

The bad news is that you no longer have a company who automatically takes off those income taxes from each cheque before you spend it.

If you’ve ever worked a regular job, you know that with each pay cheque you got, a portion of it was automatically paid to the government on your behalf. Yes, that still sucks, but since the money wasn’t deposited first in your account, you just got used to not getting your entire hourly wage or salary deposited. It was just a fact of life.

Well, when you’re an entrepreneur, it doesn’t happen that way. What gets deposited in your account doesn’t have the income tax taken off already, so if you spend it all, you’re still going to owe your taxes, but you’re gong to have nothing set aside when it comes time to pay it, unless you set it aside yourself.

Last year, if I owed $34,000 and didn’t have it set aside already, I would have been screwed. Believe it or not, I saw this happen all the time when I worked at the bank, with people owing tens of thousands of dollars in back taxes, or having to take out a loan to pay the government.

Solution: take a part of the income you generate every month, and move it to a separate savings account (they’re usually free) that’s NOT hooked up to a debit or credit card, and don’t spend it. Ever.

How much should you set aside? It varies between countries, provinces, states, cities, or municipalities, but if you’re making less than $30,000, it’s probably safe to set aside 20%.

You can calculate from my personal example above that in 2018, between my national and provincial income taxes, I paid 28.3% of my after expense income to personal income taxes (which worked out to about 17% of my income before expenses).

Again, work with your personal accountant to calculate how much you should set aside, which depends on what income tax bracket you’re in, if you contributed to a registered retirement account or charities, and other factors.

Other things to consider are if your business is a sole proprietor or incorporated (here in Canada) or an LLC (in the US), as this will separate your taxes between business and personal.

My business is still run as a sole proprietor, as it costs upwards of $5,000 to $10,000 to incorporate in Canada, with not much tax savings with what I’m making. I will consider incorporating my business at $250,000 to $300,000 in generated income.

You can see how complicated this can get, so talking with a qualified, local accountant will help you with this, along with taking someone who understands numbers with you.

Don’t just let someone else do all of this for you, you need to be a part of the conversation! You want to know how celebrities have managers who stole millions of dollars from them? They didn’t want to deal with it themselves.

Your money, your responsibility. Put your big girl panties on, look at some spreadsheets, and get yourself an income tax savings account.

#4 Fun extras

We all follow those social media influencers who have a vacation property or cottage, are building their dream house, or spend 4 months in Europe every year.

All those things cost major money, and if you’re wanting to be an entrepreneur, YOU have to make that money.

After using my free spreadsheet below to calculate the first three steps above, you might already be surprised how high the number is that you have to make each month or year. Your dream life might just be to work from home and retire your spouse, but maybe you have a dream just like the influencers above.

Ain’t no shame in wanting to live like Beyoncé, so let’s make it happen!

I have my own big dream of financing a new addition/renovation of the back of our house, including a new, high-end kitchen, master bedroom, and new bathroom. I estimate that it’ll cost us about $150,000, at the very minimum, and I’d love to pay for it with cash, and not have to refinance our mortgage.

To be honest, this big dream has felt so overwhelmingly huge over the past year that I haven’t taken much action towards it, which means that I haven’t taken that big dream and broken it into smaller ones.

If you have your own big dream or want to have some extra fun, this is how you make it happen:

Step 1 - do some research and get an estimate on what that will cost. For me, from the above example, $150,000, and I have $15,000 set aside from this year. So that leaves $135,000.

Step 2 - pick when you want it to happen. For me, it’s 3 years from now.

Step 3 - divide the total by the time frame, and you have how much you need to make each month and year. For me, that’s $45,000 a year or $3,750 per month, in after tax dollars.

Step 4 - if the number seems crazy to you, adjust your goal or time frame. For me, I could probably go on some crazy savings spree and cut other things from our budget, or hustle hard in my business to make the above amount OR I could move the goal to 5 years from now. In that case, I would have to make an extra $27,000 a year (which I’m close to doing now) or $2,250 per month.

Or I could make a deal with myself that we’ll re-finance $50,000 onto our mortgage (which is low to begin with, and property values have gone up in our area), which means to do our renovation in 3 years, I would have to save $28,333 per year or $2,361 per month.

Or you could take the easy way out and just download the free spreadsheet below that will adjust all these numbers for you ;)

No matter how big or how small your extra fun goals may be, the point is that if you don’t make a plan to save for them, they’re not likely to happen. And I know that you want to make those big dreams happen.

Now I know that not everyone loves numbers and math as much as I do, so if you’ve been simultaneously reading this blog post and hyperventilating because you’re so overwhelmed, don’t worry, I got you!

I've created a fill-in-the-blank spreadsheet that will tell you exactly how much you need to make in your business to achieve your #incomegoals, plus the training video to go with it!

You can duplicate the spreadsheet, then all you need to do is follow along with the video to fill in your personal expenses, business expenses, and any fun budget stuff you want to add in (like dream houses and vacations!), and you’ll magically get the final number you need to make every month and year to achieve all your goals.

You can then get to work making those goals happen by breaking down exactly how many new customers and clients you need to work with.

No need for the extra stress that comes with not knowing what the hell you’re doing or where you’re going, you’re going to be too laser focused for that!

JUST FILL IN YOUR INFO BELOW TO GET THE “#incomegoals” SPREADSHEET & training video!

Knowing your numbers, especially if you’re just starting out, can feel overwhelming. But that doesn’t mean that they’re going to go away.

I doubt you can afford to hire a CFO from the beginning of your business, either, and nominating your husband for that role, without even taking a look at your numbers yourself, is like wanting to get in shape but not do the exercise.

Being an entrepreneur isn’t for the faint of heart, but it sure is rewarding when you figure it out and can take control of your own life in every way!

Step #1 is making sure you know the exact goal you’re working towards, because it’s really hard to know what journey to take when you don’t know the destination.

I wanna know: what was your final number? Feeling brave? Share it in the comments below!